How AI is Distorting Our View of the Economy

AI may be driving real growth. But it’s also making it harder to see where growth isn’t happening

I’ve resisted writing about artificial intelligence for a few reasons:

First and foremost, I don’t like clickbait, and just about everyone writing about AI is only interested in jumping on a bandwagon. There are way too many articles that are either “AI is destroying our country” or “AI is the greatest thing ever invented,” neither of which is helpful. And I don’t like just doing the popular thing. I tend to be pretty disagreeable in the face of a popular consensus.1

Second, and more importantly, I didn’t feel like I actually had anything useful to contribute to the larger AI conversation. And I tend to abide by the mantra of “‘Tis better to remain silent and be thought a fool than to open your mouth and remove all doubt.” I have no plans to pretend the complexities of AI are my strong suit.

It’s been written ad nauseum that the economic data doesn’t match the popular consensus. The charts and graphs seem to show the economy is strong, but the average household is still struggling. Both things can technically be true.

The most-cited strength of the economy the last few years is the stock market. Since 2023, the annual returns for the S&P 500 have been 24.2%, 23.3%, and 16.4%. Those are astronomical numbers, way above the historical average. And since 2020, there has only been one year in which the market was down. If you invested on January 1, 2020, you would have more than doubled your money by the end of 2025. That’s quite a profit for a five-year period.

But when you dig deeper into the market gains of the last few years, it’s generally been concentrated in just seven companies: Nvidia, Alphabet (Google), Apple, Meta (Facebook), Microsoft, Amazon, and Tesla. These stocks, referred to as the Magnificent Seven, or Mag7, accounted for nearly 37% of the entire S&P 500’s market capitalization, and about 31% of the entire U.S. stock market at the end of 2025. The Mag7 also accounted for 42.5% of the S&P 500’s total 2025 return. Meanwhile, the market’s equal weight index (which treats each stock the same, regardless of its size), returned just 9.34% in 2025, underperforming the broader market by six points, and the Mag7 by an enormous amount. In layman’s terms, this means these seven stocks propped up the rest of the stock market with them. In fact, Nvidia alone made up nearly 8% of the entire stock market at the end of 2025.

Technology isn’t my expertise – business is. So the more I started seeing trends in the economy over the last few months, and in particular the disparity between the Mag7 and the rest of the market, the deeper the AI earworm kept digging into my brain. As anyone who has been a consistent reader would expect, my next step was to do some research. According to AI Invest, in the three-year period from June 30, 2022 to 2025, the weighted S&P 500 (which weighs each company based on market capitalization) returned approximately 70.9%, while the equal-weight S&P 500 (which assigns each company an equal weight of .2% of the index) returned 49.4%, highlighting the disparity in returns. “As a result,” they write, “Investors have been heavily concentrated in a subset of…technology firms, all of which are now competing in the AI space, increasing the overall risk of the market.”

Now, this is where you would expect me to go into a soliloquy about a market bubble, how it’s all about to collapse, and compare it to the dot-com bubble of the early 2000s. But to be honest, I don’t see the same risk. Yes, the dot-com bubble saw companies skyrocket in value because they said the word “Internet,” and we’re starting to see companies use the term “AI” in their quarterly earnings calls way more than ever before, even when it doesn’t apply. And there are certainly companies that are massively overvalued at the moment because of this – that much is inarguable.

But the companies at the top of this list are all profitable, and six of the seven are massively profitable. Over the trailing 12 months, here are the profits each of those six companies reported on their public financials:

Nvidia: $99 billion

Apple: $112 billion

Alphabet: $124 billion

Microsoft: $105 billion

Amazon: $76.5 billion

Meta: $58.5 billion

And here are their free cash flow (a more accurate depiction of their financial strength):

Nvidia: $77 billion

Apple: $123 billion

Alphabet: $73.5 billion

Microsoft: $77 billion

Amazon: $10.5 billion

Meta: $46 billion

These companies’ stock prices may be riding a high, but they’re not at risk of going anywhere or falling at the pop of the proverbial bubble. If Apple wants to spend over $100 billion per year on capital expenditures related to AI, I can disagree with the decision without thinking it’s going to turn the company from a success to a failure. Put it in numbers closer to our comprehension as mere mortals: if you sold your business for $10 million, and told me you wanted to buy a $250,000 Ferrari, I would tell you it’s irresponsible, but I wouldn’t worry about an impending bankruptcy.2 That’s not to say the market can’t crash from being overvalued, but these companies themselves are highly unlikely to go anywhere even if the bubble bursts. Their core, profitable businesses will generally be unaffected.

The Wall Street Journal reports that Meta, Alphabet, Amazon, and Microsoft are actively spending nearly $120 billion per quarter on capital expenditures, most of it building AI data centers.

And while we can all discuss and disagree about the worthiness of these expenditures, this is real money actually being spent. These are construction jobs, maintenance jobs, and ongoing investments in the country’s technological infrastructure. Five, ten years down the line, we will see if it was the correct investment, but for the time being, I don’t necessarily see how this is any different than other industrial revolutions that we’ve gone through as a society. If this is the direction we’re heading, then I would rather have companies invest in it early on so that we do it properly. We’ve still got areas of the country that don’t have reliable Internet, 25 years after the dot-com boom. I think it’s reasonable to suggest that we didn’t properly invest in the technology back then – perhaps we can make up for it this time around.

But here’s where the risk lies for those of us that don’t live in the world of big business and technology: most businesses, and especially small businesses, do not participate in the mechanisms creating these numbers. Whether or not over-investing in AI is the correct move, those companies not involved in AI are living in a different economic reality.

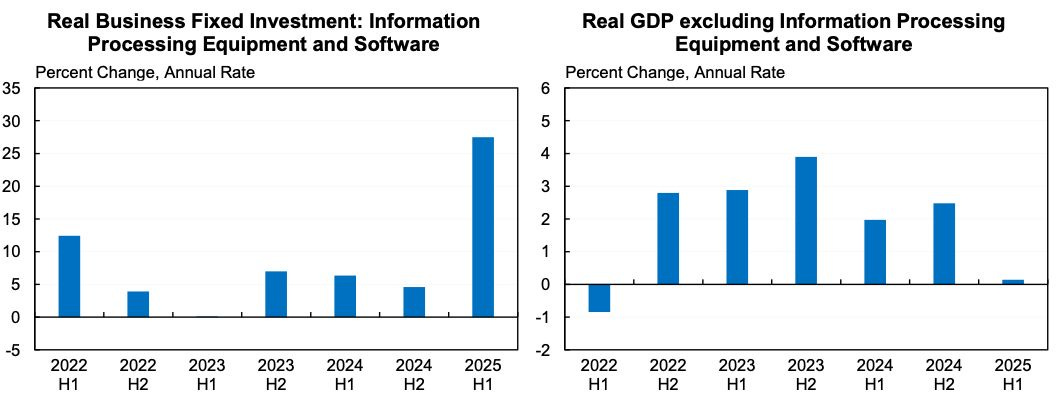

Harvard Economist Jason Furman reported that investment in information processing equipment and software was responsible for 92% of H1 GDP in 2025. Without these technology-related categories, GDP growth for that six-month period would have been just 0.1%. And according to CNBC, “A September 2025 analysis from Deutsche Bank argued that without AI-related investment, the US economy might already be in a recession.”

I recently wrote about how small businesses are getting left behind in the current economy. I can put an addendum onto that piece by saying, small businesses and those businesses not involved in AI feel like they’re getting left behind in the current economy. There are now two economies: the asset/capex economy, and the cash-flow economy. Small businesses live in the cash flow economy, but that’s not where the growth is.

The companies driving AI-related growth benefit from everything currently driving economic growth. And their multi-billion-dollar investments show up immediately in GDP, employment numbers, and market indices. Small businesses, on the other hand, don’t issue stock. They don’t borrow against soaring equity values. They don’t spend half of their company’s worth on infrastructure and patiently wait for annual returns. They live on cash flow, margin, and whether this month’s sales cover payroll.

The risk isn’t that AI-driven growth is fake – it’s real. The risk is that this growth convinces people the economy is healthier than it is, which delays the reckoning for those living outside the AI economy. For those of us that live in the cash-flow economy, it’s crucial to not use asset-economy signals to judge yourself and your business. By severing the ties between these two realities, you’re less likely to feel like you’re falling behind, and more likely to understand that you exist in a different economy than the one most news outlets write about.

We all have to make business decisions based on our places in our own economy. Everyone should learn about, utilize, and leverage whatever part of AI can help within their own business, while continuing to reap any benefits that advancing technology provides. But always keep in mind the economic realities of your own space, rather than just reading the big-picture numbers without the proper context. Because a chart without context is just decoration.

Just ask my wife.

And if you’re going to be that fiscally irresponsible, might I request a Purosangue? Just park it in front of my house.