Cash Flow - The Lifeblood of a Small Business

Everyone focuses on revenue and profit when analyzing their business. But the real determining factor of continued success is cash flow.

As all business owners know, the cash in your bank goes up and down throughout any given time of a fiscal year, for a variety of reasons. But just knowing the number in your bank account today or yesterday doesn’t give you the information necessary to properly check the health of your finances. That’s where cash flow comes in. Quite simply, cash flow refers to that up and down pattern of cash you have on hand at any given moment. To me, it is the most important piece of financial data that you can know at any given time.

There are so many pieces of research out there showing how much difficulty business owners have in keeping on top of their cash on hand. According to Intuit, only half of small business owners believe they have a good understanding of financial management – and 74 percent say that their cash flow challenges have stayed the same or worsened in the last year. A U.S. Bank study found that 82 percent of businesses fail due to poor cash flow management. Fifth Third Bank found that nearly half of small business owners don’t have enough cash to meet their business goals. And Wasp Barcode Technologies report that over half of small businesses don’t even track their assets.

Intuit also reports that low financial literacy can cost small business owners as much as six figures in lost profit. Cash flow is the most important piece of information that lets you know how your business is running. “Think of profit as the theory of your business success,” writes The Hartford, “And cash flow as the reality.”

Most of us have, at some point, been the victim of a cash crunch in business. A pile of bills come suddenly due, and, depsite your business growing and being quite profitable, you somehow are scraping together pennies to make payroll. It’s a terrifying experience, one I normally wouldn’t wish on anybody. Although, living that experience once or twice may be one of the best lessons for an entrepreneur. It always sticks in the back of your mind the razor’s edge we all occasionally occupy in small business. It makes you focus much more heavily on your financial health as the years progress.

To understand cash flow, it’s important to understand the three major financial statements: income statement (also called a profit and loss statement), balance sheet, and statement of cash flows. I’ve gone through the first two in-depth previously, but will reiterate the basics here. The income statement shows all revenues and expenses, as well as net profit, reported by your company for accounting purposes for a period of time (quarterly, annually, etc). The balance sheet shows, at any given moment of the corporation’s life, what assets and liabilities are outstanding for the company.

Both of those reports, however, are mostly accounting formulas. The number you report as net profit is not equivalent to the amount of money you actually made or lost. All sorts of accounting tricks can artificially bump the net profit figure higher or lower – in fact, there are plenty of times when a company can report a seven-figure “profit” on their income statement, and yet not have the cash available to pay the income tax on it because they didn’t actually make that much money.1 A balance sheet is helpful to see how valuable a company is, but also has plenty of accounting tricks that can artificially increase or decrease the numbers on either side of the ledger.

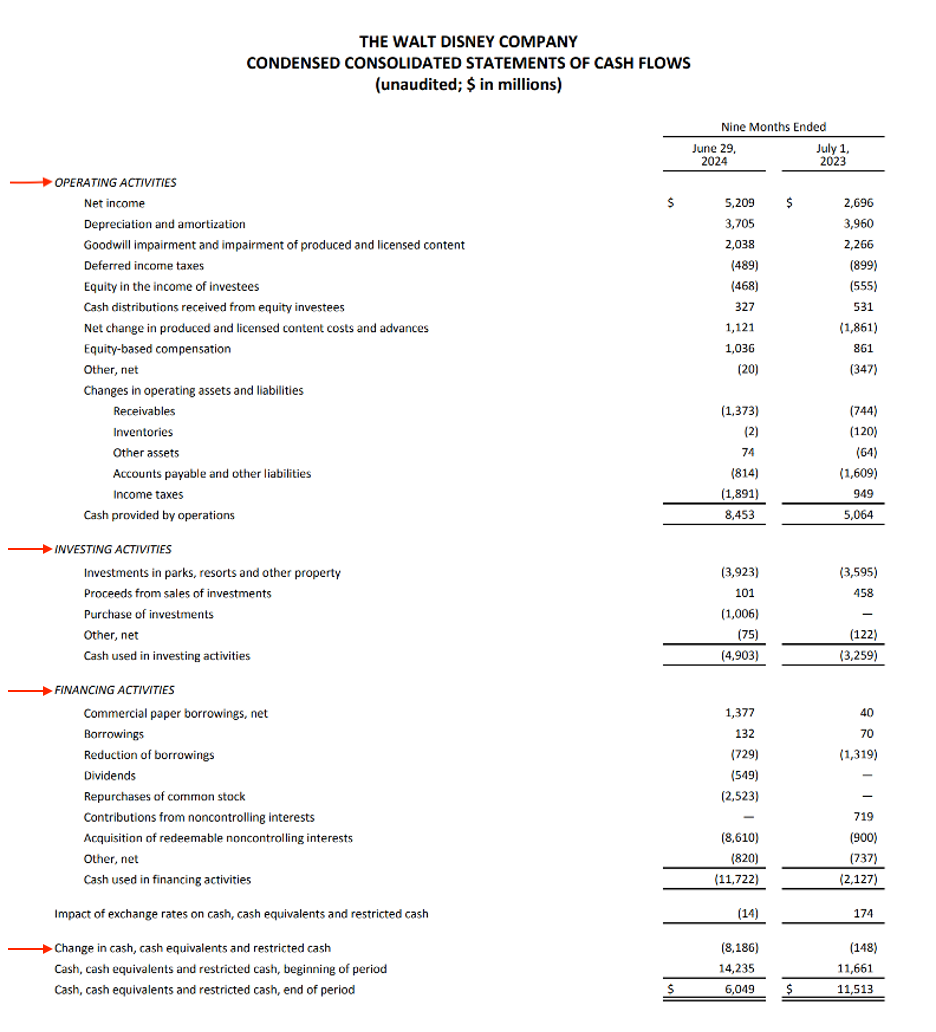

A statement of cash flows, however, is the most accurate way to determine how successfully a company is run on a monthly, quarterly, or annual basis. Take the below cash flows statement from The Walt Disney Company, for example:

A statement of cash flows is separated into three sections: operating activities, investing activities, and financing activities.

The operating section is exactly what it suggests: the ebbs and flows of a company’s cash based on their operations. In Disney’s case, that involves their parks, movies, cruises, resorts, merchandise, television networks, and plenty more. You can see, in Disney’s case, the various factors that increase or decrease the operating cash flow during a year, ultimately resulting in a nine-month operations cash flow of $8.45 billion.

The investing section refers to any money outlayed (or received) related to major assets in the company. In Disney’s case, that refers to any capital they’ve put toward building new attractions, refurbishing existing attractions, purchasing investments, or money they’ve made from selling investments. For most regularly-operating companies, especially small businesses, the investing section will show a net negative, because you are more likely to put money into your company than sell existing assets.

The financing section refers to any money received or outlayed from various capital options outside of your company’s coffers. This includes bank loans, common stock, an infusion of capital from an investor, and more. Depending on where you are in your business’s life, this number can go in either direction. In Disney’s case, their net financing number is negative because, although they took on over $1 billion of new debt, they also outlayed an enormous amount of money toward dividends, buying back stock, and paying off old debt. In your company’s case, if you have an outstanding loan and are not taking on new debt, your net financing number will show a negative as you pay off existing loans. If you’re in the process of taking on more capital for any reason, your net financing number will show a positive.

The bottom line numbers will show the cash at the beginning and end of the given period. The difference between these two is what’s called “free cash flow.” That figure is one of the more important numbers to know about your company. It essentially tells you, irrespective of profit, revenue, or any other financial data point, how your company did in bringing in cash during the year.

Now, there’s a huge caveat to that – you can artificially inflate your free cash flow in a number of ways. You can take on an enormous loan, for example. The statement of cash flows doesn’t care that the loan will cost you a whopping 12 percent per year in interest. It just cares that you have the cash at this moment.

This is why understanding the entirety of your company’s cash flow statement is one of the most important things you can do to better your business’s health. Unless you’re a brand-new startup, your operating cash flow should be positive as often as possible. How the rest of the financial statement stacks up depends on what your strategy is for the coming year(s).

Now, unfortunately a statement of cash flows only gives you the information at the end of a specific period. As a business owner, you need to be aware of how your cash flow is doing well before those financial statements are created. Fortunately, most modern bookkeeping software has cash flow data to help you keep track of your spending as you go. The software we use for our companies actually has a giant cash flow number for the last 14, 30, 60, 90, or 365 days. This allows us to see, at any given moment, how we’ve been doing and how much cash we’ve collected and outlayed during any period. Most software also has an accounts payable section, where you can keep track of upcoming bills and how much money you will need in the coming weeks or months.

However, I always urge someone to have a deep understanding of these numbers outside of whatever software you may use. Some bills come suddenly, while you may simply forget about others that come at the same time each year. Just because there isn’t a bill in your file to pay, doesn’t mean it doesn’t exist. Here are some big expenses that don’t always show up in an automated cash flow forecast:

Taxes: this can include property tax, which often gets billed later than the due date each year; and quarterly income tax payments, both federal and state.

Equipment: is a crucial part of your business nearing the end of its useful life, perhaps a piece of equipment or your property? You may not have a bill for that, but if the roof starts leaking, or if your computer server starts to go, you don’t have a choice but to fix it as soon as possible.

Loans: do you have a commercial loan with a non-fixed rate? Maybe it balloons soon and you’ve forgotten? Or maybe the interest rate changes with the market.

Payroll and bonuses: payroll generally isn’t sitting in your software or your file as a “bill to be paid.” It’s usually just done on your regular schedule. You know how much your payroll usually runs – be sure to account for that number. If it’s the time of year you usually give out bonuses, remember to calculate ahead the amount of cash you need for it.

Unexpected inventory purchase: does a vendor or supplier run a special each year that essentially forces you to put excess money into inventory in a slower time of year? You may want to do that for profitability purposes, but that doesn’t help your cash flow right now. Be sure to balance those two issues when making these purchases.

If your cash flow is constantly struggling, you may want to ask yourself these questions: is your poor cash flow a result of inefficient operations? Are you billing customers properly and timely? Are you collecting customers’ money efficiently? Are you paying suppliers late, thereby forfeiting early pay discounts? Are you paying them too early, thereby outlying excess cash when you don’t necessarily have to? Do unexpected expenses keep popping up, suggesting you don’t have a full grasp of your company’s financial operations?

These are questions that we are constantly reviewing in my companies. Not only do we take the sum of the upcoming bills, but we run the gamut every week or so and make sure we’ve accounted for every single outlay of cash that might possibly come. Usually, we end up overestimating that number – but that’s better than the alternative. The only question that truly matters to the health of a small business is “do I have enough cash to cover my expenses.” In order to answer that question at any given time, be sure to have a deep understanding of what goes into your company’s cash flow and how you can account for it throughout each year.

**Main Street Mindset will be off for the next few weeks. Wishing everyone a great holiday season and a Happy New Year. See you all in 2025!**

Any business that holds high levels of inventory can see this happen quite easily. Depending on which method of accounting you use, you could see your net income artificially increase by having more inventory than you did the previous year. That creates a sort of double whammy, where you’ve outlayed more money, while also owing more in taxes.