How Well Do You Know Your Business’s Finances?

You don’t need to be a CPA, but you do have to know every crucial number off the top of your head.

One of my favorite shows is Restaurant Impossible. Sure, it’s the same script every episode – Robert Irvine walks in, the place is a mess, the food is terrible, and by the end of 40 minutes everything has been fixed perfectly. I can take the dirty kitchens, the health violations, and the subpar cooking. But the one part that makes me grimace and groan every time1 is when he sits down to interview the business owner at the beginning of the episode, and the owner can’t answer basic financial questions about their business. The questions Robert asks are not complex – they are simple questions like, “what was your revenue last year,” “what was your food cost,” “what is your overhead.” I’m someone who has never and will never be in the restaurant business, but I can still state confidently, these are numbers that a restaurant owner – that any business owner – should know.

I’m not a CPA. Frankly, I don’t even have a business degree. But that doesn’t mean I don’t know every major number about my businesses at any moment. It’s not because I’m “good with numbers” – it’s because I make a conscious effort to ensure I know these data points, for the betterment of my companies.

Thanks for reading Main Street Mindset! Subscribe for free to receive new posts and support my work.

A quote I love, from former president Calvin Coolidge, helps shed light on this: “At times I dream of balance sheets and sinking funds, and deficits, and tax rates…I regard a good budget as among the noblest monuments of virtue.”2 He’s 100 percent right. Knowing your finances are in order is the biggest stress reliever amidst the millions of tasks we have to do each day as business owners. And remaining ignorant to those numbers doesn’t make potential problems dissipate.

You don’t have to be a financial whiz to run a business – we’ll talk eventually about hiring those that complement your weaknesses. But your number one job as a business owner is to keep your company solvent. You can’t do so without knowing these basic numbers at any given time:

Revenue

It’s obvious that you should know how much your business brings in each year in raw sales. But the more important point is that, if your company obtains revenue from different sources, you should know the breakdown. If you’re in retail, know the categories that make up each portion of your total revenue. If you’re an e-commerce operation, know what you bring in from product sales vs. shipping revenue, etc. If you’re in a service business, know how much each type of service brings in.

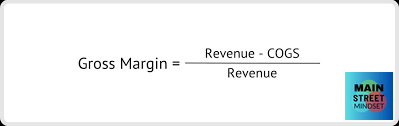

Gross margin

Especially if you run a retail operation (or any business where you sell goods), you should always know how much money you’re making on any item you sell. Some businesses operate with the same gross margin across the board, while others work on different margins by category or department. Sometimes, you will need to carry items that have a low margin, in order to draw the clientele to purchase your other, higher-margin products.3 At the end of the day, it is impossible to know whether or not your business can exist profitably unless you know how much you make on each sale.

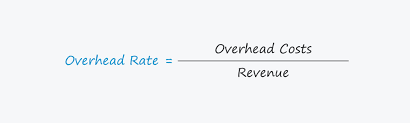

Overhead rate

Overhead is the portion of your expense that is constant – it exists whether you open your doors that morning or not. Knowing this figure is critical to your business, as it is impossible to know if your business model is profitable without it. We use this statistic often – if a potential supplier argues that we only need a miniscule gross margin on their product, we shoot back with “it costs us XX percent just to turn on the lights.” It’s a powerful statement, but you need to have the data in order to use it. While each business’s overhead will vary, generally these items will be part of your calculation:

Building costs (rent/property tax/maintenance)

Utilities

Internet and phones

Insurance (business liability and workman’s comp)

Salaries

Supplies

Software

Legal/accounting

License/local fees

Cash flow

We’ll do a deep dive into cash flow in a future newsletter, but you need to know off the top of your head how much cash you are bringing in at any moment, as well as how much cash you have to outlay in the coming weeks or months. A lot of companies have heavier levels of annual bills around the anniversary of their incorporation. Or you may have placed a large order with a vendor because they gave you extended payment terms – but do you remember that months later when the bill is coming due? Just because you are profitable doesn’t mean you have a positive cash flow. Profit is only an accounting number on a financial document.

Break-even point

If you know what your overhead is, and you know what your gross margin is, then you can calculate this number very easily. Just take your overhead number and divide it by your gross margin. It can tell you exactly how much revenue you need to bring in each day, week, month to break even. In calculating this, remember that if you’re in a variable cost business (where your expenses scale along with your revenue), you need to take that growth into account by using percentages as opposed to nominal figures. If you’re in a fixed cost business (where your expenses don’t rise when your revenue does), it’s a pretty easy nominal calculation. Just make sure to calculate your overhead number consistent with whichever timeframe you’re using.

Average order value

Whether you’re in retail or a service industry, it is crucial to know the average amount that each customer will spend with you. Not only does this help you determine how much is worthwhile to spend on acquiring (or retaining) a customer, but it allows you to do various calculations about spending money on your business. For example, if you’re considering adding a piece of software that costs $10,000 per year, you can use most of the aforementioned data points, as well as average order value, to determine if it’s worthwhile. If your gross margin is 30%, then you know you’ll need $30,000 in additional sales to cover this new cost. If your average order value is $100, you know you’ll need 300 additional transactions to do so. Now you can look at your operations and ask the question, “Can I add 300 additional transactions by adding this software?” Suddenly the decision is much easier to quantify.

Bonus: Revenue per employee

While this isn’t a crucial data point, it’s one that I’ve actually found to be helpful, especially if you have multiple businesses. Revenue per employee (Revenue divided by employees) shows you how efficient your operations are. With my three businesses, it is sometimes difficult to compare and contrast them, because they are in three different parts of the same industry, with three drastically different revenue numbers, and different numbers of employees. By using this statistic, I can get an idea of which business is running the most efficiently, and which company may need some extra attention. Just don’t use this data point as an internal competition, or you will find yourself doing way too much on your own in order to maximize the number. That’s never good for anyone.

So, how well do you know these statistics in your own business?

My wife can attest to this

Nerd alert!

This is not the same as a “loss leader”, where you actively lose money on a product in order to draw customers in. I would always advise against using loss leaders, it is a recipe for failure.