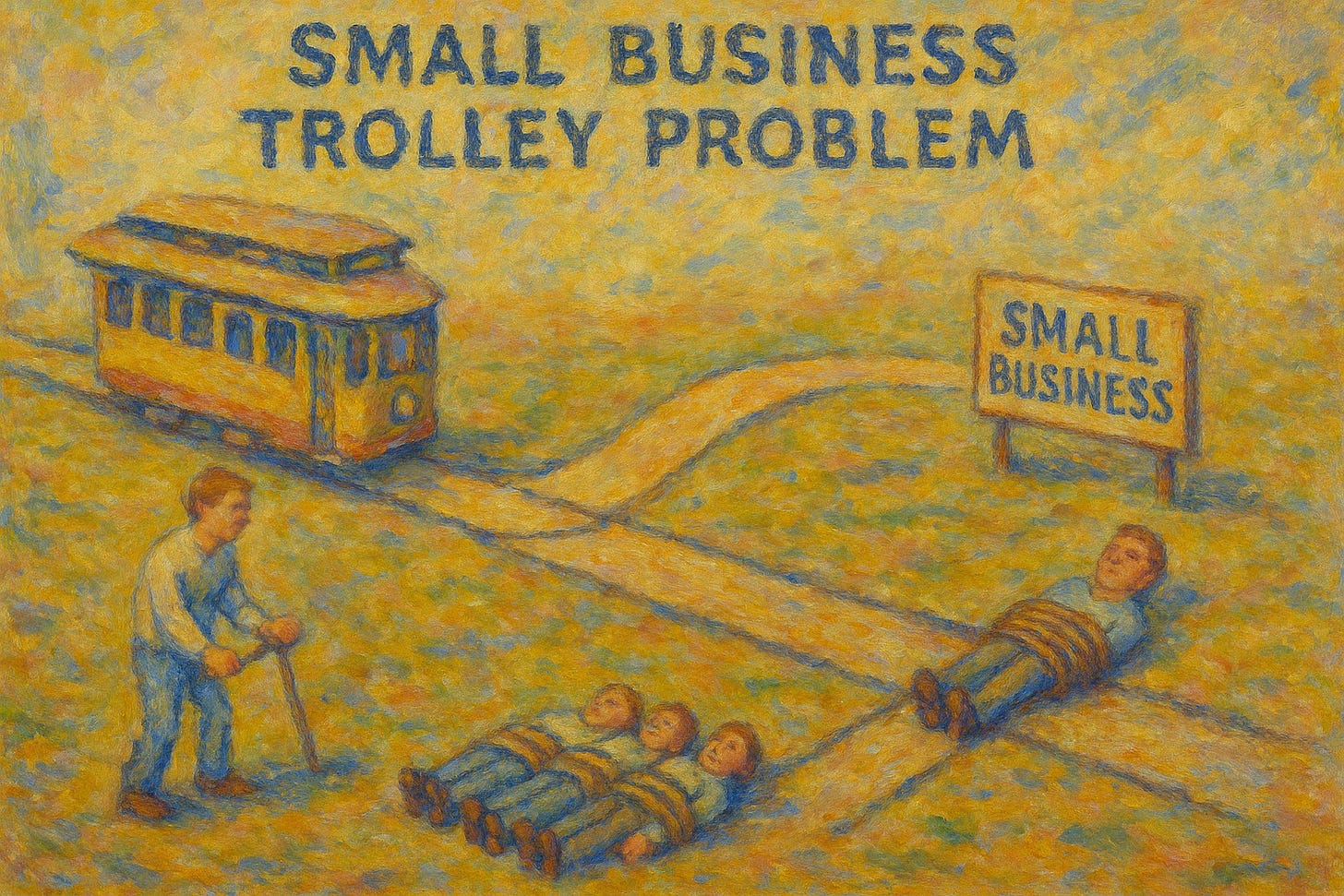

The Small Business Trolley Problem

Errors of omission are often treated differently than errors of commission. It’s how small businesses usually end up falling behind.

Most of you have heard of the trolley problem before. If you haven’t, here’s a brief review:

A trolley is going down a set of tracks. It’s heading in a direction that will run over five people currently on the tracks. However, you can pull the lever and force the trolley to the other track, where just one person is standing. Do you pull the lever?

This is one of the oldest philosophical thought-pieces. Essentially, it’s asking if you’re willing to let five people die by doing nothing, or cause one person to die by pulling the lever. Most people say they have no problem pulling the lever, because they see it as saving four lives.

But if you make the example more realistic, you can throw a wrench into the thought process. Say you’re a doctor, facing five patients who will die if they don’t get transplants by the end of the day. And you have a single patient with all of the needed organs. Are you willing to kill the one patient in order to harvest the organs and save the other five? Or are you comfortable doing nothing and letting the five patients perish?

There are all varieties of the trolley problem, some more ridiculous than others. But the bottom line is that it forces us to come face-to-face with the issue of omission vs. commission.

Omission means you fail to do something right by not doing anything. Commission is when you make a decision, but you do it incorrectly. Omission is passive; commission is active. Here are a few examples:

Commission: a doctor prescribes medication that the patient turns out to be allergic to – the patient dies.

Omission: a doctor takes no action when faced with a patient’s symptoms - the patient dies.

Commission: a witness lies under oath in order to put someone behind bars. The defendant is found guilty.

Omission: a potential witness fails to offer exonerating evidence. The defendant is found guilty.

Commission: telling a lie.

Omission: withholding the truth.

Commission: bullying someone.

Omission: watching someone else get bullied.

There are countless examples of this through all walks of life. And some of the fun in these mental exercises is seeing what variables you can add to the equation. You can try a wacky version of the trolley problem here.

In general, the human brain is wired to commit sins of omission, rather than sins of commission. We do not want to actively harm anyone else. Oftentimes, that becomes irrational. Other times, it’s right.

Look at the entire medical profession. The Hippocratic Oath says, “First do no harm.” It doesn’t say “Do good.” It doesn’t say “Heal sick patients.” First and foremost, we’ve been taught, do not harm another person. And that’s fantastic advice, when your career involves life or death decisions, or when the fate of another human is potentially in your hands.

But in business, most decisions we make are not life or death. In fact, I can’t remember any time I’ve made a decision that had those types of consequences. Almost every decision we make is ultimately financial, even the difficult decision to lay someone off.1 Yet, in business, missing out on a great opportunity is viewed as less problematic than taking a risk and failing. I’d like to say this is perplexing, but it’s not. This is how our brains are wired. Be risk-averse, be safe, “first do no harm.”

When we engage in “omission” as business leaders, we’re essentially saying that we’re afraid of failure or error. That’s perfectly rational – no one wants to fail. No one wants to make a mistake or make the wrong decision. But as a business leader, those around you are relying on your decision-making abilities. You end up in your role because you have to be able to make those difficult decisions. Frankly, if you couldn’t, you likely wouldn’t be in your position anymore.2

I’m certainly a victim to the omission vs. commission bias on a regular basis. No one likes change, no one likes risk, and no one likes the chance of failure. But I often think back to the riskiest business decision we’ve ever made as a family, one that I was at the forefront of. Years ago, we had the opportunity to acquire a company that would help us vertically integrate within our industry. It was a larger financial risk than we had ever committed to, and we were terrified. Our company has always been conservative and fairly risk-averse. This was not one of those moments.

The safe thing to do would be to carry on with the status-quo. But we had done an incredible amount of analysis, as did the professionals we hired, and we saw exactly what the financial benefit was going to be over the course of the next ten years. Even with those numbers slapping us in the face, we still were afraid to pull the trigger. I honestly can’t remember, this many years later, what finally convinced us to okay the deal. But I’m assuming it was our family collectively saying something to the effect of, “F**k it”.

As it turns out, it was perhaps the smartest business decision we’ve ever made. Our analysis was spot on, and 13 years later we’re still reaping the benefits. That doesn’t mean that any risky decision is worth making. But it means that, if you’ve done all of your homework, all of your research, and have triple-checked yourself, it’s irrational not to do something that will benefit your business.

We have certainly failed at many things. And though it doesn’t feel like it at the time, years later no one remembers those failures, including yourself. Many leaders are more comfortable doing nothing than something, because if you do nothing and fail, you are less likely to be criticized. If you do something and fail at it, you are more likely to be criticized for making a bad choice. But that thought process will inhibit growth in your business. Do your homework, look at the pros and cons, and make a decision based on what will be best for you and your business. Pull the lever. Even if it’s a little terrifying.

Save for terminating an employee for cause.

If it’s not your business, you likely will end up fired. If it is your business, you likely will lag behind your competition and end up out of business.

The affect heuristic, that drives much of our decision-making when it comes to risk, tends to see risk and benefit as negatively correlated, when in fact objective data indicate that they have a positive relationship. Toss in prospect theory (for which Daniel Kahneman won a Nobel Prize in Economics; https://www.jstor.org/stable/1914185?seq=3) and you've got the theoretical basis for this well-written and informative post. Thanks for sharing your insights, Alan.